Want to minimize student loan debt while attending college or graduate school? A work-study job can help.

The federal work-study program ensures part-time jobs are available to undergraduate and graduate students with financial need.

How do you apply for the program?

How much money can you make?

What types of jobs can you get?

Are work-study jobs better than traditional part-time jobs?

Great questions! We’ll answer all of them (and more) in this guide so you know exactly what to do when you see your work-study award amount in your financial aid package.

Let’s begin.

TABLE OF CONTENTS

(click to skip ahead)- What is the federal work-study program?

- Federal work-study program eligibility and requirements

- How to apply for the federal work-study program

- How does the federal work-study program work?

- How much can you earn from work-study?

- State work-study programs

- Benefits of work-study jobs

- Work-study vs loans

- More information on how to pay for college

What is the federal work-study program?

The federal work-study program is a government-funded program that helps undergraduate and graduate students secure part-time jobs to pay for education expenses.

The money you earn from a work-study job supplements other forms of federal financial aid, such as grants and federal loans. You do not need to pay back money earned from work-study.

Some colleges and universities partner with off-campus organizations, such as non-profits, to offer students work-study jobs. However, most work-study jobs are on-campus to ensure you can easily balance your work with your academic schedule.

Work-study jobs are also typically community-service oriented or related to your academic field. Some examples of work-study jobs include:

Hospital lab assistant

Library clerk

Academic tutor

Child care provider

Research assistant

College admissions student ambassador

Intern at an off-campus non-profit organization

Administrative staff support in an on-campus organization

Administrative staff support in an on-campus academic department

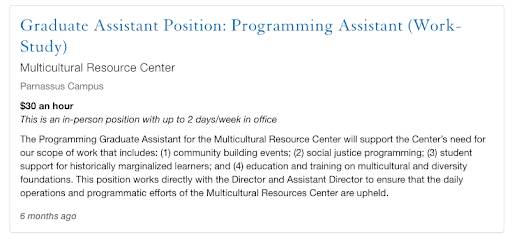

Here are two examples of work-study positions at the University of California San Francisco (UCSF):

Federal work-study program eligibility and requirements

If you have financial need as determined by the Free Application for Federal Student Aid (FAFSA), you’re likely eligible for the federal work-study program.

The program is available to both part-time and full-time students at the undergraduate or graduate level.

According to the U.S. Department of Education, around 3,400 colleges and universities currently offer students the opportunity to participate in the federal work-study program.

However, not all schools offer work-study. To ensure your school participates in the federal work-study program, check with the financial aid office.

How to apply for the federal work-study program

To apply for the federal work-study program, you just need to submit the FAFSA.

The FAFSA opens to applicants every year on October 1 (though in 2023/24 there were serious errors and delays). If you’ve never filled out the FAFSA or have doubts about completing it, check out this resource: How to FAFSA.

We recommend submitting the FAFSA as early as possible since, like all forms of federal financial aid, schools have limited work-study funds available.

You’ll know if you qualify for work-study and exactly how much you can earn for one academic year when you receive your financial aid award letter. You’ll typically receive this letter a few weeks or months after submitting the FAFSA.

If your financial aid award letter does not include a work-study offer but you believe you should qualify, consider submitting a financial aid appeal letter.

How does the federal work-study program work?

Submitting the FAFSA and receiving an offer for work-study in your financial aid package are just the first steps. You’ll still need to find, apply, and secure a work-study job on your own.

Fortunately, many colleges and universities make it easy for students to find work-study jobs.

Typically, there will be an online job portal that lists open positions for students qualifying for work-study. The link we shared above for USCF students is one such example.

After submitting a job application, you’ll likely need to attend an interview with the employer and, if hired, agree to a set of responsibilities and schedule.

The schedule for most work-study jobs is flexible so that work does not interfere with your academic commitments.

How much can you earn from work-study?

Undergraduate students can earn between $1,000 to $4,000 per year from work study. Graduate students can earn up to $5,000 per year.

According to Sallie Mae's “How America Pays for College 2023 Report”, the average amount awarded for work-study is $1,821.

Undergraduate students with work-study jobs get paid by the hour at least once a month. Graduate students may also be paid by the hour or receive a monthly salary.

All work-study jobs pay at least the federal minimum hourly wage. However, you can only earn up to the amount listed on your financial award letter.

For example, if you’re offered $2,500 for a year of work-study and take a job paying $30 per hour, you can only work around 83 hours during the entire academic year. You also have the flexibility to work fewer hours and earn less than the total amount offered.

There’s also no obligation to take a work-study job if you don’t want one. If you don’t get a work-study job, the money offered to you will simply go back to the university’s financial aid funds.

State work-study programs

Even if your school does not participate in the federal work-study program, you may still be able to find a work-study job through a state-funded program.

State work-study programs may also be a good option if you’d like to explore more job options than those listed by your school.

The following links provide more information on several state work-study programs:

The eligibility requirements for these programs vary. But typically, you’ll need to be a state resident, submit a federal and/or state financial aid form, and demonstrate financial need.

State work-study programs are not currently available in every state. Check with your school’s financial aid department or your state's department of higher education for more information.

Benefits of work-study jobs

Some part-time jobs pay more than work-study jobs. So, why would you consider applying for this type of job? Here are a few top benefits of work-study jobs that can make them the better option.

You have job security on campus

A typical part-time job might require you to spend hours commuting, eating into your valuable time and potentially causing fatigue before even starting your shift.

Most work-study jobs are on-campus, making it easy to balance your work commitments with your academic responsibilities.

You’re also less likely to be laid off unexpectedly or have your hours cut from work-study jobs since the employer receives the funds to pay you directly through a government-funded program.

Your hours and schedule are flexible

You can only work a set number of hours with a work-study job.

Typically, the employer is mindful of your academic schedule and won’t require you to work more hours than you can handle while balancing your studies. You can easily cut down your hours if your school work becomes more demanding, say during final exam periods.

You also won’t have to worry about taking time off during regular holidays and breaks when your campus is closed.

Your earned income doesn’t affect your financial aid eligibility

Unlike money earned from a typical part-time job, the money you get from a work-study job isn’t calculated into your FAFSA.

That means the money you earn from work-study won't reduce your eligibility for financial aid, allowing you to earn income without risking your financial assistance.

You still need to report the money you earn on federal and state income taxes. However, your work-study income is exempt if you work less than 20 hours per week and attend school full-time.

You can minimize student loans

As mentioned earlier in this guide, you don’t need to pay back the money earned from work-study jobs.

That means money earned from work-study is much better than money received through student loans, which must be paid back after you graduate, with interest. (See next section for more.)

There are also no requirements on how you spend the money earned from a work-study job. Most students use the money to pay for everyday expenses while attending school.

Work-study vs loans

If you have to choose between getting a work-study job or taking out an additional student loan, we highly recommend you choose the job.

At the end of 2023, the average college graduate with a four-year bachelor’s degree had $37,090 in student loan debt, according to the U.S. Department of Education’s Office of Federal Student Aid.

According to the Education Data Initiative, it also takes the average borrower 20 years to pay back student loans.

Of course, with a limit on how much you can work and earn per year, a work-study job won’t eliminate every student’s need for student loans.

But suppose you can cover some of your expenses through a work-study job. In that case, you'll reduce the amount you need to borrow in student loans, ultimately lowering your overall debt burden upon graduation.

More information on how to pay for college

Need more advice on how to find your college or graduate education without getting into frustrating student loan debt? Check out these resources:

Crash Course on How to Pay for College (Using as Little of Your Own Money as Possible)

A guide on how to pay for grad school

Special thanks to Ameer Drane for writing this blog post.

Ameer is a freelance writer who specializes in writing about college admissions and career development. Prior to freelancing, Ameer worked for three years as a college admissions consultant at a Hong Kong-based education center, helping local high school students prepare and apply for top colleges and universities in the US. He has a B.A. in Latin American Studies from the University of Chicago and an M.A. in Spanish Linguistics from UCLA. When he’s not working, Ameer loves traveling, weight lifting, writing, reading, and learning foreign languages. He currently lives in Bangkok, Thailand.

Top values: Growth / Diversity / Empathy